reverse tax calculator bc

On January 01 1991 goods and services tax GST was introduced in Australia. History of the Property Transfer Tax.

Gst Calculator Goods And Services Tax Calculation

See the article.

. This reverse tax calculator will help you to know the purchasesell amount before and after tax apply. Reverse Sales Tax Formula. Sales Tax Calculators Canada Reverse Sales Tax Calculator.

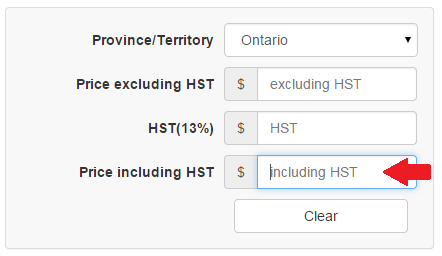

An online reverse sales tax Remove Sales tax calculation for residents of canadian territories and provinces with high accuracy. 2021 free British Columbia income tax calculator to quickly estimate your provincial taxes. Formula for calculating reverse GST and PST in BC.

The second tab lets you calculate the taxes from a grand total including tax and gives you the subtotal before tax. Sales tax calculator. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find.

Tax rate for all canadian remain the same as in 2016. This simple PST calculator will help to calculate PST or reverse PST. Why A Reverse Sales Tax Calculator is Useful.

Calculator formula Here is how the total is calculated before sales tax. British Columbia Manitoba Québec and Saskatchewan. Reverse GSTHST Calculator Total after taxes Province Best 5-Year Variable Mortgage Rates in Canada nesto 180 Get This Rate Butler Mortgage 184 Get This Rate CIBC 259 BMO 265 Promotional Rate RBC 270 TD 270 Get This Rate Fixed Rate Variable Rate Check Canada Mortgage Rates From 40 Lenders Find your GSTHST rebate for a new home.

New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island. Reverse GSTPST Calculator After Tax Amount Best 5-Year Variable Mortgage Rates in Canada nesto 190 Get This Rate Andy Hill 195 Get This Rate BMO 265 Promotional Rate TD 270 Get This Rate CIBC 274 RBC 275 Fixed Rate Variable Rate Check Canada Mortgage Rates From 40 Lenders Sales Taxes Across Canada for 1000. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021. This calculator should not be considered a substitute for professional accounting or legal advice. Type of supply learn about what supplies are taxable or not.

The Provincial Sales Tax PST applies only to three provinces in Canada. Useful for figuring out sales taxes if you sell products with tax included or if you want to extract tax amounts from grand totals. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST rate QST amount Margin of error for sales tax.

If you want a reverse GST PST calculator BC only just set the calculator above for British Columbia and it will back out the 12 combined tax rate for the amount you enter in. 1000 1 57100 1000 112 89286 89286 x 5100 4464 GST 89286 x 7100 6250 PST Margin of error for sales tax An error margin of 001 may appear in reverse calculator of sales tax in British Columbia. To calculate the total amount and sales taxes from a.

Province of residence Employment income Self-employment income Other income incl. All you have to input is the amount of sales tax you paid and the final price on your receipt. CERB RRSP contribution Capital gains Income taxes paid Calculate Estimated amount 0.

The rate you will charge depends on different factors see. The 5 Goods and Services Tax is expected to bring 408 billion in. Divide the price of the item post-tax by the decimal value.

It can be used as well to reverse calculate Goods and Services tax calculator. British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST. Ad a tax advisor will answer you now.

Originally called the Property Purchase Tax the PPT was first introduced in 1987 as a wealth tax to discourage speculation and cost 1 of the first 200000 and 2 of the remainder although 95 of home purchases did not qualify for the tax at the time as they were below the 200000 mark. Use this calculator to find out the amount of tax that applies to sales in Canada. Reverse Sales Tax Formula Calculates the canada reverse sales taxes HST GST and PST Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST.

1000 1 57100 1000 112 89286 89286 x 5100 4464 GST 89286 x 7100 6250 PST Margin of error for sales tax An error margin of 001 may appear in reverse calculator of sales tax in British Columbia. This will combine the GST and PST and you can enter the amount to then reverse it out. In fact the last increase in HST was for Prince Edward Island a raise of 1 on october 1 st 2016 see the article.

Income Tax Calculator British Columbia 2021 Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Amount with sales tax 1 gst and pst rate combined100 amount without sales tax amount with sales taxes x gst rate100 amount of gst in bc. Amount HSTGST variable Total Amount Current HST GST and PST rates table of 2020 On March 23 2017 the Saskatchewan PST as raised from 5 to 6.

What is GST rate in Canada. For example if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205. GSTHST provincial rates table The following table provides the GST and HST provincial rates since July 1 2010.

The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association. Get started Your Results Total income 0 Total tax 0. Calculate GST with this simple and quick Canadian GST calculator.

File your tax return today Your maximum refund is guaranteed. Only four Canadian provinces have PST Provincial Sales Tax. When was GST introduced in Canada.

In Québec it is called QST. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432That means that your net pay will be 40568 per year or 3381 per month. Amount without sales tax gst rate gst amount.

It is easy to calculate GST inclusive and exclusive prices. Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to. Here is how the total is calculated before sales tax.

If you have a tax bill worth 13000 you can use the 1000 to reduce your payment to 12000. Current Provincial Sales Tax PST rates are. The information used to make the tax and exemption calculations is accurate as of January 30 2019.

Hst reverse sales tax calculation or the harmonized reverse sales tax calculator of 2021 for the entire canada ontario british columbia nova scotia newfoundland and labrador and many more canadian provinces If you make 52000 a year living in the region of british columbia canada you will be taxed 10804.

Canada Sales Tax Gst Hst Calculator Wowa Ca

How To Calculate Sales Tax Backwards From Total

Reverse Hst Calculator Hstcalculator Ca

Pst Calculator Calculatorscanada Ca

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Pin On Design Wishlist Products

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Adding A Reverse Mortgage To Your Nest Egg Strategy Marketwatch Reverse Mortgage Mortgage Refinance Calculator Refinance Mortgage

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Sales Tax Canada Calculator On The App Store

Reverse Hst Calculator Hstcalculator Ca

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

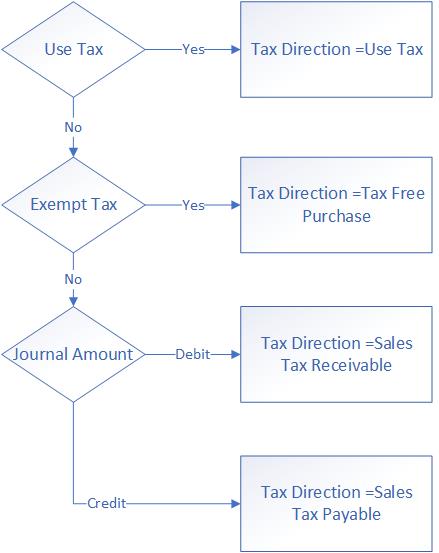

Sales Tax Calculation On General Journal Lines Finance Dynamics 365 Microsoft Docs